Collateral

Description

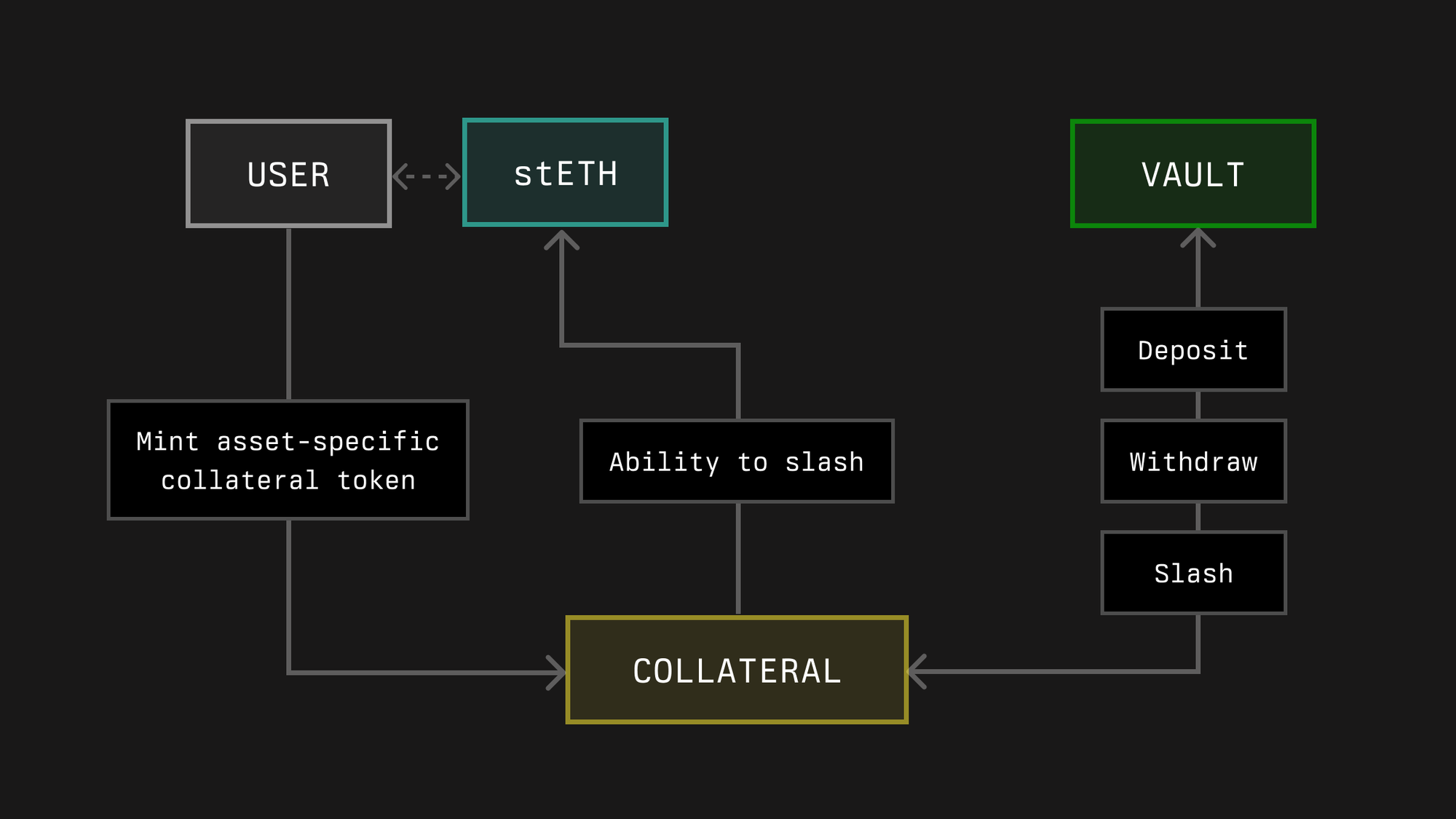

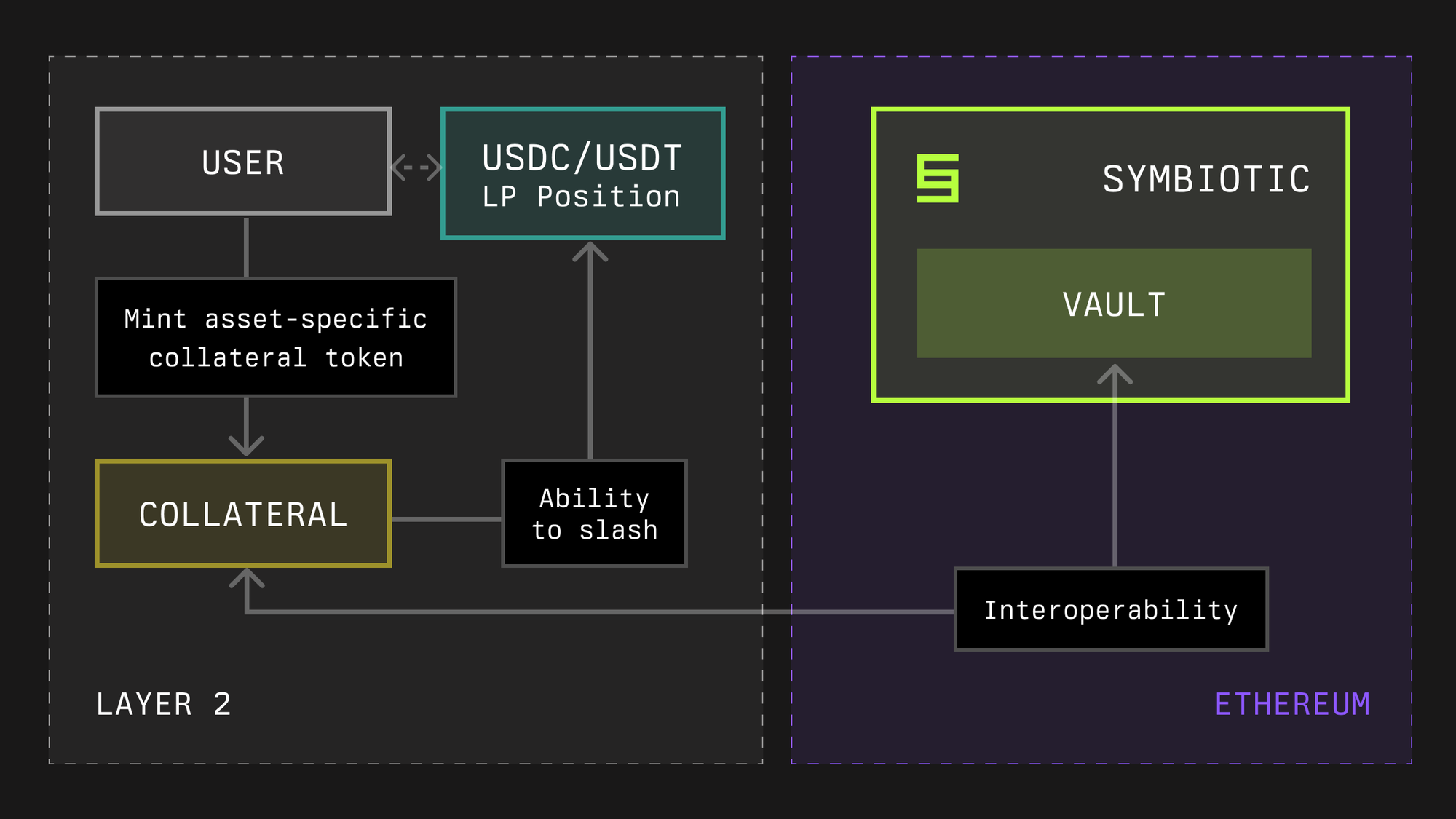

Collateral is a concept introduced by Symbiotic that brings capital efficiency and scale by enabling assets used to secure Symbiotic networks to be held outside of the Symbiotic protocol - e.g. in DeFi positions on networks other than Ethereum.

Symbiotic achieves this by separating the ability to slash assets from the underlying asset itself, similar to how liquid staking tokens create tokenized representations of underlying staked positions. Technically, collateral positions in Symbiotic are ERC-20 tokens with extended functionality to handle slashing incidents if applicable. In other words, if the collateral token aims to support slashing, it should be possible to create a Burner responsible for properly burning the asset.

For example,

- if the asset is ETH LST - it can be used as collateral if it’s possible to create the

Burnercontract that withdraws ETH from the Beacon Chain and burns it. - if the asset is a native governance token - it can be used as collateral since the

Burnermight be implemented as a "black-hole" contract or address.

Symbiotic allows collateral tokens to be deposited into vaults, which delegate collateral to operators across Symbiotic networks. Vaults define acceptable collateral and its Burner (if the vault supports slashing), and networks need to accept these and other vault terms such as slashing limits to receive a stake (these processes are described in detail in the Vault section).

Technical Overview

We do not specify the exact implementation of the Collateral, however, it must satisfy the following requirements:

- Collateral token must support the ERC-20 interface.

- [OPTIONAL] Collateral token should be slashable i.e. native token or derivative that supports redeeming the underlying native token. (Only if collateral is used in slashable vaults).

Default Collateral

Default Collateral is a simple implementation of the collateral token. Technically, it’s a wrapper over any ERC-20 token with additional slashing history functionality. This functionality is optional and not required in general case.